A Limited Liability Company (LLC) is a common business structure that allows either one person or multiple people to own a portion of a company. The profits the LLC generates are passes through to members and the LLC is not required to file a separate tax return as a corporation is. It also reduces the exposure of the owner or owners to liability from company activities.

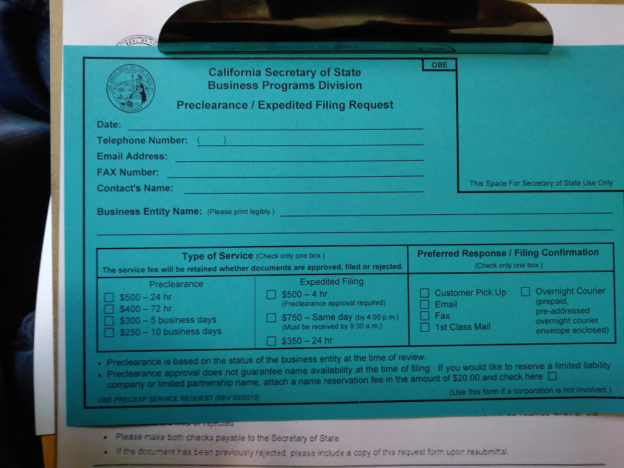

Our firm will help you file your LLC in California. We provide routine and Ca SOS expedited LLC filing with the Sacramento Secretary of State which is located at 1500 11th St, Sacramento, CA 95814. Your documents will be delivered by hand to the Sacramento Secretary of State’s office.

Order LLC Filing Services

Questions: (916) 238-6629

How to Set Up an LLC in Sacramento, CA

Step 1: Select a Suitable Name

California law demands having a unique name for your business. You can check the state’s website for suitable names or our service can check for you once you place your order. It is even possible to reserve a desired name if you wish to start the company at a later date.

Step 2: Find an LLC Organizer and Designate a Registered Agent

The organizer is the company or person that’s responsible for drafting your LLC. You are also required to designate a registered agent who is either a corporation or a person. It is important to have one since it is needed for the Articles of Organization.

Start Your Company For Just $49 + State Filing Fees

Step 3: Decide the Ownership and Management Structure

The Articles of Organization states whether your California LLC will be managed by multiple managers, one manager, or all members. It is up to you to choose whether you want a manager-managed or member-managed LLC.

Step 4: Create the Operating Agreement

The Operating agreement is a legal engine that powers the business, creates its governance, manages the working capital, and pays out its profits. Critical issues of voting, money, liability, and even fiduciary constraints are all at stake here.

Step 5: File the Articles of Organization

California requires you to file the Articles of Organization, which is a 1-page form that provides your company details. The moment when the California Secretary of State accepts your Articles of Organization is when your company is created. To file the Articles of Organization, you must provide the name and address of the company, the LLC organizer, your management method, and your registered agent.

Step 6: Obtain Your EIN and Open a Bank Account for the Business

If you have followed the steps above, you are now a registered California LLC. LLCs with more than one member are required to file with the IRS for an Employer Identification Number (EIN), whether or not you have employees. The EIN is also required by most banks if you wish to open an account for the business.

Step 7: File a Statement of Information within 90 Days

You are required to file a Statement of Information (SI) within 90 days of forming your California LLC. After the initial filing, you will be required to file an updated SI every 2 years. The Statement of Information is used for keeping the state updated on your company information. If you make changes to your company down the road, the SI will be one of the forms that you will be required to file with the state.

How to Dissolve a California LLC

Creating and dissolving an LLC in Sacramento involves filing documents with the secretary of state. The documents that you are required to file will depend on the status of the company and whether or not the owners have unanimously voted in favor of dissolution.

Step 1: Select a Suitable Dissolution Method

California law recognizes 3 methods of dissolving LLCs. A California LLC can be dissolved by filing a Certificate of Cancellation (i.e. Form LLC-4/7) and Certificate of Dissolution (i.e. Form LLC-3). If all owners/members of the LLC choose to dissolve, you just have to file a Certificate of Cancelation (i.e. Form LLC-4/7).

If the LLC is less than 12 months old and doesn’t have any debts besides tax liability, has not conducted any business since the Articles of Organization was filed, has returned any investment or assets, and the majority of members and managers have voted in favor of dissolution, you can dissolve it by filing only a Short Form Certificate of Cancellation (i.e. Form LLC-4/8).

Step 2: Fill Out the Certification of Dissolution (i.e. Form LLC-3)

Fill out the Certificate of Dissolution (i.e. Form LLC-3) if appropriate. You should provide the name of your LLC as well as the filing number. You can also include any other relevant information. Sign and date the form and don’t forget to provide the name and address of a person to receive a filed copy of the document.

Step 3: Fill out the Certification of Cancellation (i.e. Form LLC-4/7)

Fill out the Certificate of Cancellation (i.e. Form LLC-4/7) if appropriate. Provide the name of your company as well as the LLC filing number. Indicate whether the dissolution was the result of a unanimous vote by all the members. You can also include any other relevant information. Sign and date the form and don’t forget to provide the name and address of a person to received a filed copy of the form.

Step 4: Fill Out the Short Form Certificate of Cancellation (i.e. Form LLC-4/8)

Fill out the Short Form Certificate of Cancellation (i.e. Form LLC-4/8) if appropriate. Provide the name of the company and the LLC filing number. Indicate whether the company has satisfied all known debts and distributed all known assets or whether it has no known assets. Indicate whether a majority of managers or members have voted in favor of dissolution or whether the company doesn’t have any managers or members. Sign and date the form, and provide the name and address of a person who will receive a filed copy of the form.

Step 5: File with the Secretary of State

File all documents with the Sacramento secretary of state. It does not require a fee to submit dissolution or cancellation documents. You are, however, required to file to dissolve by mail. The mailing address for the California secretary of state is Document Filing Support, P.O. Box 944228, Sacramento, CA.

If you would like assistance with setting up or dissolving your California LLC, you should hire our firm to file your LLC documents.